Welcome to Gold Investor Monday, May 19 2025 @ 12:36 pm EDT

Forget drugs, we could be in the era of gold mules

- Sunday, April 06 2014 @ 11:22 am EDT

- Views: 3,475

That may not be universally applicable but if you go by the media coverege it may well be the case in India; gold > drugs. Not to mention the special skillset required to sneak in this metallic substance in the age of metal detectors and heightened vigilance against gold transportation across national borders; again at least in India. You can't swallow a kilo or two of gold nuggets wrapped in a condom and then crap them out at your destination. Or can you? Skimming through some news reports, this headline instantly caught my eye and resulted in a chuckle or two:

That may not be universally applicable but if you go by the media coverege it may well be the case in India; gold > drugs. Not to mention the special skillset required to sneak in this metallic substance in the age of metal detectors and heightened vigilance against gold transportation across national borders; again at least in India. You can't swallow a kilo or two of gold nuggets wrapped in a condom and then crap them out at your destination. Or can you? Skimming through some news reports, this headline instantly caught my eye and resulted in a chuckle or two:

"Woman flyer wears 6 undies to hide 2kg gold"

No crapping out gold but oh what lengths will smugglers go to find desperate mules and come up wtih inventive schemes - all in the name of meeting the gold demand of 1.3 billion people whose government insists it knows what is best for them.- read more (160 words)

- Post a comment

- Comments (0)

Royal mint strikes coins from WW2 sunken silver

- Friday, April 04 2014 @ 02:12 pm EDT

- Views: 8,038

The Royal Mint will be releasing special commemorative silver coins made from 2,800 bars of silver that were recovered by the American marine exploration company Odyssey Inc, off the coast of Ireland. The silver bars were on board the British merchant ship SS Gairsoppa and which was sunk by a German U-Boat in 1941. As part of the war effort, the silver was being transported from Calcutta, India to Liverpool when the ship was lost with its precious cargo. The wreck was first discovered in September 2011 at a depth of 3 miles on the ocean floor. The salvage effort was quite monumental in being able to recover 3.2 million troy ounces of silver from the this great depth.

The Royal Mint will be releasing special commemorative silver coins made from 2,800 bars of silver that were recovered by the American marine exploration company Odyssey Inc, off the coast of Ireland. The silver bars were on board the British merchant ship SS Gairsoppa and which was sunk by a German U-Boat in 1941. As part of the war effort, the silver was being transported from Calcutta, India to Liverpool when the ship was lost with its precious cargo. The wreck was first discovered in September 2011 at a depth of 3 miles on the ocean floor. The salvage effort was quite monumental in being able to recover 3.2 million troy ounces of silver from the this great depth.

- read more (49 words)

- Post a comment

- Comments (0)

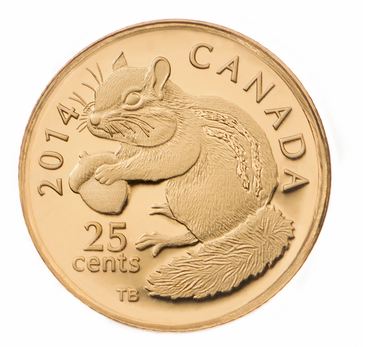

Canadian Mint's half gram gold coin

- Friday, March 28 2014 @ 03:00 pm EDT

- Views: 3,401

Yes, you read that right - a half gram gold coin. I like the Royal Canadian Mint, even with its many overly priced "numismatic / non-circulating legal tender coins", but I am a bit taken back by why anyone would want to buy a half gram coin. I have seen one of the 1/25 ounce, or 1.24 gram, gold coins that RCM makes and it was tiny and barely legible while ensconced in its protective plastic capsule. Its hard to appreciate the art, that makes these 1/25 ounce coins "collectables" so I now only imagine how small, and frail the even smaller half gram, or 0.016 ounce gold coins would be.

Yes, you read that right - a half gram gold coin. I like the Royal Canadian Mint, even with its many overly priced "numismatic / non-circulating legal tender coins", but I am a bit taken back by why anyone would want to buy a half gram coin. I have seen one of the 1/25 ounce, or 1.24 gram, gold coins that RCM makes and it was tiny and barely legible while ensconced in its protective plastic capsule. Its hard to appreciate the art, that makes these 1/25 ounce coins "collectables" so I now only imagine how small, and frail the even smaller half gram, or 0.016 ounce gold coins would be.

In real life the coin will have a diameter of just 11 mm but thankfully we have a nice big picture of this coin, which is denominated at 25 cents and features the cute, cuddly and hardworking Canadian chipmunk designed by artist Tony Bianco. The mint will produce 10,000 of these half gram 99.99% pure gold coins and sell them for C$79.95 ($72.30). I won't bother calculating the premium being paid over the price of gold, because it will be insane.

- read more (131 words)

- Post a comment

- Comments (0)

Gold price slides even as central banks buy

- Thursday, March 27 2014 @ 03:35 pm EDT

- Views: 3,267

After failing to break through a key $1,400 per ounce mark, the price of gold has been on the downswing, almost giving up all its gains for 2014 (currently quoted at $1,292 / oz). This comes on the heels of a few reports of several central banks having been buyers of gold in February and with increased geopolitical tensions in Ukraine and Eastern Europe. China’s gold imports from Hong Kong rose amid increasing demand, to 109.2 metric tons in February, compared with 83.6 tons in January and 60.9 tons in February of last year.

After failing to break through a key $1,400 per ounce mark, the price of gold has been on the downswing, almost giving up all its gains for 2014 (currently quoted at $1,292 / oz). This comes on the heels of a few reports of several central banks having been buyers of gold in February and with increased geopolitical tensions in Ukraine and Eastern Europe. China’s gold imports from Hong Kong rose amid increasing demand, to 109.2 metric tons in February, compared with 83.6 tons in January and 60.9 tons in February of last year.

- read more (216 words)

- Post a comment

- Comments (0)

South Korea opens physical gold trading market

- Sunday, March 23 2014 @ 10:34 am EDT

- Views: 3,659

The country that ranks amongst the 15 largest economies in the world and a powerhouse in Asia, will just now start to trade physical gold on the open market. The South Korean regulators first announced this move in mid-2013 and starting tomorrow, the Korea Exchange Inc. bourse will begin trading 1 kilogram bars of 99.99% gold (in minimum 1 gram increments). This spot gold trading will come in addition to trades in gold futures contracts that are already established in South Korea. This move is expected to move some of the underground trade in gold to the official exchange and bring additional (tax) revenue for the government.

The country that ranks amongst the 15 largest economies in the world and a powerhouse in Asia, will just now start to trade physical gold on the open market. The South Korean regulators first announced this move in mid-2013 and starting tomorrow, the Korea Exchange Inc. bourse will begin trading 1 kilogram bars of 99.99% gold (in minimum 1 gram increments). This spot gold trading will come in addition to trades in gold futures contracts that are already established in South Korea. This move is expected to move some of the underground trade in gold to the official exchange and bring additional (tax) revenue for the government.

- read more (162 words)

- Post a comment

- Comments (0)

Contemporary Canadian art on a 2 oz gold canvas

- Tuesday, March 18 2014 @ 01:07 pm EDT

- Views: 4,231

The Royal Canadian Mint is well known for gold, silver and platinum bullion coins that are much loved by precious metals investors but its real money maker is the vast number of numismatic coins geared towards collectors. These non-circulating legal tender (NCLT) coins are limited run coins that sell at a large premium to the underlying gold, silver, platinum or base metal value. They meet the needs of pure coin collectors and can help precious metals investors diversify their coin holdings.

The Royal Canadian Mint is well known for gold, silver and platinum bullion coins that are much loved by precious metals investors but its real money maker is the vast number of numismatic coins geared towards collectors. These non-circulating legal tender (NCLT) coins are limited run coins that sell at a large premium to the underlying gold, silver, platinum or base metal value. They meet the needs of pure coin collectors and can help precious metals investors diversify their coin holdings.

The $250 Contemporary Canadian Art gold coins features an original work of art by renowned Canadian artist Tim Barnard. He was commissioned by RCM to design the reverse side of the coin with 50 distinct images symbolizing elements of Canada ranging from the country's weather, First Nations culture and mythology, wildlife, plants, rugged geography and more. The standard Susanna Blunt portrait of Queen Elizabeth II is found on the obverse of this gold coin.

- read more (150 words)

- Post a comment

- Comments (0)

Indian gold dealers seem to have had enough

- Wednesday, March 12 2014 @ 02:49 pm EDT

- Views: 3,340

The Indian authorities just don't seem to be able to make up their mind on what to do about its populace's love of gold. It seems that recent rumours of easing up have not panned through as Indian gold dealers and jewelers seem to be ready to call it quits.

The Indian authorities just don't seem to be able to make up their mind on what to do about its populace's love of gold. It seems that recent rumours of easing up have not panned through as Indian gold dealers and jewelers seem to be ready to call it quits.

"The jewellery trade in Mumbai was hit with members of the Indian Bullion and Jewellers Association downing shutters to protest against the restrictive trade policy of the Government. Mohit Kamboj, President, IBJA said: “Our call for a bandh today to protest against government policies was successful as nearly 90 per cent bullion traders in Mumbai, Maharashtra and Kolkata have observed the bandh. Except for big retailers, almost all wholesalers and manufacturers have joined the strike”. IBJA called for a day’s strike today to protest against harassment of bullion dealers and jewellers by various Government agencies."

- read more (39 words)

- Post a comment

- Comments (0)

Harry Browne's Permament Portfolio

- Saturday, March 08 2014 @ 10:24 pm EST

- Views: 3,795

Investors, investment writers, pundits and advisers spend a lot of time mulling and pontificating about how to diversify and structure their portfolios. A whole field in finance - Modern Portfolio Theory (MPT) - has been developed and researched to tackle this challenge of maximizing portfolio returns for a given amount of risk which of course, we would like to be minimized. But we still have many views on how diversified, if at all your portfolio should be and in most cases, financial advisers stick to the time honoured advice when it comes to gold. Hold 5% of your portfolio in gold as insurance, either in the form of gold mining stocks, gold certificates or more recently gold ETFs. Then we have the other side where the advise is often about impending doom and gloom, driving investors to hold the majority of their investment in gold (silver and other precious metals). Is there any middle ground?

Investors, investment writers, pundits and advisers spend a lot of time mulling and pontificating about how to diversify and structure their portfolios. A whole field in finance - Modern Portfolio Theory (MPT) - has been developed and researched to tackle this challenge of maximizing portfolio returns for a given amount of risk which of course, we would like to be minimized. But we still have many views on how diversified, if at all your portfolio should be and in most cases, financial advisers stick to the time honoured advice when it comes to gold. Hold 5% of your portfolio in gold as insurance, either in the form of gold mining stocks, gold certificates or more recently gold ETFs. Then we have the other side where the advise is often about impending doom and gloom, driving investors to hold the majority of their investment in gold (silver and other precious metals). Is there any middle ground?

I guess anyone could put together a portfolio that is somewhere between the 5% gold and 95% gold but one that has existed for a while and is worthy of a re-look is the Permanent Portfolio. Investment newsletter and book writer Harry Browne, introduced the Permanent Portfolio in his book, Fail-Safe Investing: Lifelong Financial Security in 30 Minutes. This book provides readers with a lot of advice on how to invest (Browne presents 17 rules on investing) and it is probably best known for its suggested portfolio allocation where gold plays a major role.

- read more (183 words)

- Post a comment

- Comments (0)

Indian government may ease curbs on gold imports

- Tuesday, March 04 2014 @ 09:03 pm EST

- Views: 3,314

India has historically been a huge market for gold, mostly because we know that Indians like to wear their wealth. In all seriousness, they have gotten good at protecting their purchasing power with hard assets or foreign currencies over the continually declining Rupee. The Indian government has been trying to unsuccessfully curb this appetite for gold but there is hope that they may look to ease up on some of the gold import curbs.

India has historically been a huge market for gold, mostly because we know that Indians like to wear their wealth. In all seriousness, they have gotten good at protecting their purchasing power with hard assets or foreign currencies over the continually declining Rupee. The Indian government has been trying to unsuccessfully curb this appetite for gold but there is hope that they may look to ease up on some of the gold import curbs.

" The Ministry of Commerce and Industry today made a case for easing curbs on gold imports as over - regulation is encouraging smuggling of the yellow metal. “I have been of the consistent view that we have to have a balance. Over - regulation leads to another problem...and that is smuggling. Therefore, some easing is essential,” Commerce and Industry Minister Anand Sharma told reporters here."

- read more (49 words)

- Post a comment

- Comments (0)

Gold price manipulation study released

- Friday, February 28 2014 @ 01:40 pm EST

- Views: 3,762

Many gold (and silver) investors have long suspected that the price of precious metals may have been manipulated by entities within the financial world, central banks and governments. Cartel type pricing already exists in some commodities so fixing the price of gold may not have been that far fetched, except that gold still plays a role as a financial asset. Investigations over the last half decade have raised questions about the pricing in many financials markets including sub-prime mortgage securities in the US, LIBOR, interest rate swaps, oil, silver, aluminum, and more. Bloomberg now reports that a draft study points to signs of gold price manipulation, with the punchline:

Many gold (and silver) investors have long suspected that the price of precious metals may have been manipulated by entities within the financial world, central banks and governments. Cartel type pricing already exists in some commodities so fixing the price of gold may not have been that far fetched, except that gold still plays a role as a financial asset. Investigations over the last half decade have raised questions about the pricing in many financials markets including sub-prime mortgage securities in the US, LIBOR, interest rate swaps, oil, silver, aluminum, and more. Bloomberg now reports that a draft study points to signs of gold price manipulation, with the punchline:

"Unusual trading patterns around 3 p.m. in London, when the so-called afternoon fix is set on a private conference call between five of the biggest gold dealers, are a sign of collusive behavior and should be investigated..."

- read more (96 words)

- Post a comment

- Comments (0)